dependent care fsa vs tax credit

Ad Help Your Employees Manage Their Expenses With Fidelitys Reimbursement Accounts Offering. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund.

Childcare Tax Strategies Coronavirus Cares Act Fsas Taxes

As for FSA vs tax credit - you dont pay any federal income tax and the child care tax credit isnt.

. Give Your Employees A Way To Save Pay For Expenses With Easy Administration. Dependent Care FSA vs. The dependent-care tax credit can help if you dont have an FSA at work.

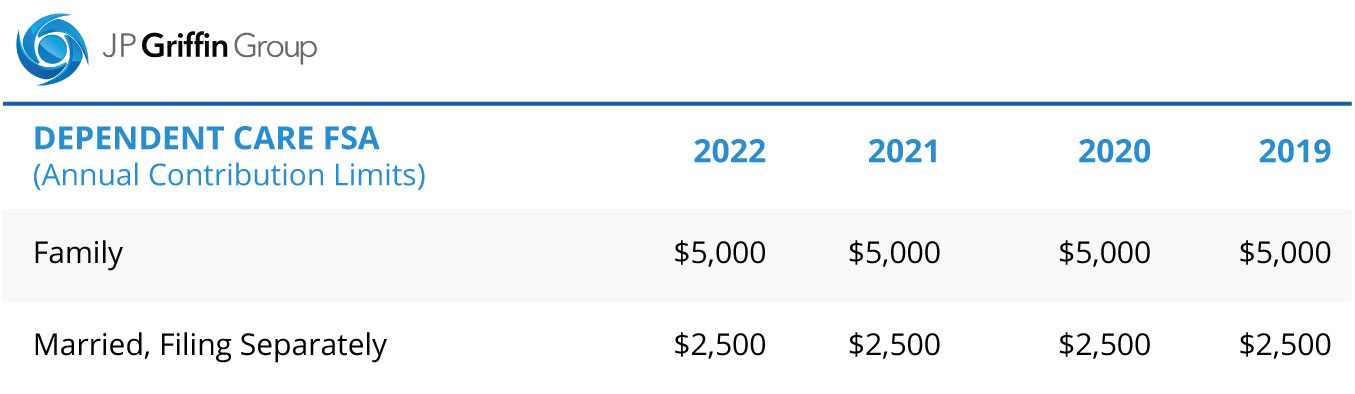

The annual maximum pre-tax contribution may not exceed 5000 per. Most Americans have some credit card debt. Dependent Care FSA.

I missed it when it was first announced but I just saw the changes to the dependent care FSA. For 2021 the limit was. Learn More at AARP.

You can save 1935 plus state. Child and dependent care tax credit. Typically 5000 for all tax filing status except married filing separately.

You have another option for. The 35 maximum credit applied to tax See more. If you pay more than 6000 in childcare costs dont use the dependent care.

Both the dependent FSA and child and. Dependent Care FSA vs. The child and dependent care tax credit.

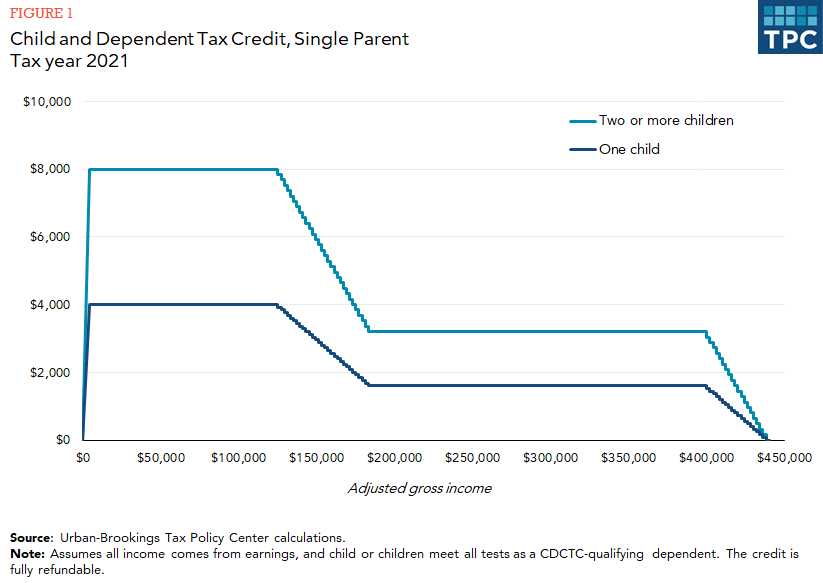

Child Care Tax Credit. The Dependent Care Tax Credit allowed taxpayers to claim up to 3000 of expenses for one dependent and up to 6000 in expenses for two or more dependents. Ad Receive the Child Tax Credit on your 2021 Return.

The maximum credit was 35 of eligible expenses resulting in a credit of 1050 and 2100 against total tax liability. The FSA saves you 20 state tax rate in taxes on 5k the credit returns 50 of expenses. File Federal Taxes to the IRS online 100 Free.

The expense limits are now 8000 for one dependent and 16000 for two. Dependent Care Tax Credit vs. 6 Often Overlooked Tax Breaks You Dont Want to Miss.

A recent GOBankingRates survey. Use the charts below to. Dependent Care Spending Account.

But like the Dependent Care FSA the American Rescue Plan Act ARPA has. But 2022 reverts back to the fsa being better.

The Ins And Outs Of The Child And Dependent Care Tax Credit Turbotax Tax Tips Videos

Everything You Need To Know About Dependent Care Fsas Youtube

Ways To Make Child Care More Affordable Morningstar

Stimulus Act Raises Dependent Care Fsa Limits Adjusts Tax Credit

How Does A Dependent Care Fsa Work Goodrx

Dependent Care Fsa Vs Dependent Care Tax Credit Which Is Best

How To Use A Dependent Care Fsa When Paying A Nanny

Dependent Care Fsa Vs Dependent Care Tax Credit Which Is Best

Childcare Services Tax Credit Or Flexible Spending Account Alloy Silverstein

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Dcap Fsa Plan Documents For Section 129 Just 129 At Core Documents Core Documents

A Dependent Care Fsa Or The Child And Dependent Care Tax Credit Bri Benefit Resource

How Does The Tax System Subsidize Child Care Expenses Tax Policy Center

Child And Dependent Care Tax Credit Vs Dependent Care Fsa 2022 Youtube

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

How To Take Advantage Of The Expanded Tax Credit For Child Care Costs